Our Mission

Integer sodales dictum mattis. Nunc ullamcorper efficitur

Our Clients are the most prized possession and prospect. Our voluminous Client list speaks for itself. Ever since of our inception, we have represented, helped and guided everyone from startups to MNCs. Our work ethics is based hand in hand priority for all.

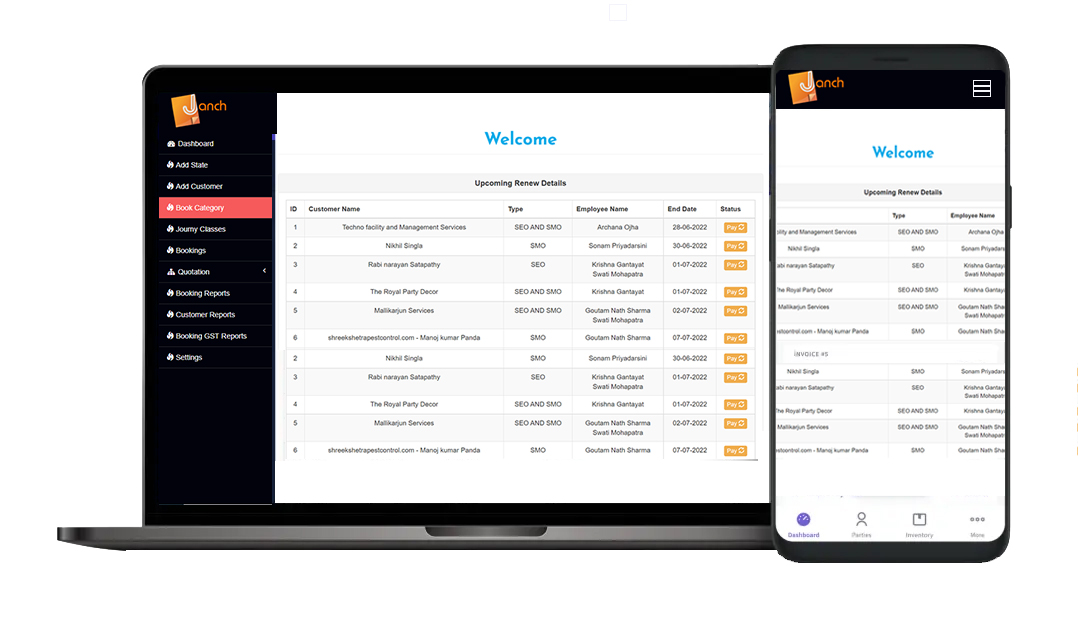

A billing and invoicing software helps businesses streamline & automate their day-to-day billing and accounting operations. Janch Software is best billing software in India designed to aid small & medium business owners run their operations from anywhere & anytime. Business owners can create customised GST invoices & non-GST invoices within seconds and share them on WhatsApp with their clients. In addition, one can monitor unpaid invoices and send payment reminders from the free gst billing software.

Janch Software is a GST billing software that helps small business owners manage their business accounts right from their mobile & desktop. The GST software helps business owners to streamline their business processes, which saves a lot of time and monetary resources. It is the most affordable billing software available in the market for SMB owners.

Invoices and bills are the same but different depending on the perspective. An invoice is sent to a customer, and upon receipt, it is termed as a bill. A business owner requests money against an invoice, and a customer sends money against a bill/receipt.

Invoices and bills serve the same purpose but are different in some ways. An invoice must contain an invoice number, which may or may not be in the case of a bill. Invoices include more detailed information about products or services, while bills are less detailed and only give an overview of a transaction.

A tax invoice is different from a regular invoice because it includes details like GST and VAT. Tax invoices are often used for reporting purposes while invoices can be used for both financial reporting and claiming a tax credit; however, you need to use a GST invoice to claim the credit.

Janch Software is the best billing software with GST designed to help small business owners run their business processes easily. It is an ideal software for businesses where invoicing is one of the core business activities. Also, businesses looking to digitise their operations to understand their financial position better can use it. It helps them create bills (GST & non-GST), record purchases & expenses, maintain inventory and manage payables/ receivables directly from their mobile phones or computers. Also, the app generates critical business reports that help business owners make effective business decisions.

Professional billing software can help you in many ways. Some

are as follows:

1. Eliminate redundant entries and save time by using

professional billing software to create GST invoices & non-GST

invoices

2. Digitise, organise and manage your business properly

3. Accept online digital payments seamlessly

GST Billing software helps businesses reduce a lot of manual efforts that also decreases time spent on managing operations using pen-paper. With billing software, business owners can manage their day-to-day operations easily & track their growth on a regular basis.

Invoices are issued prior to payment, whereas receipts are issued after. Invoices act as a request for payment, and receipts act as proof of payment.

An invoice is a document issued by a business to its client/customer, whereas a bill is issued by the client to the business. An invoice will typically detail the amount owed by the client, outlining what is being purchased, while a bill will detail what has been provided in return for payment.